The Business Taxes in Nebraska are imposed on businesses operating within the state. Businesses that have nexus in Nebraska are subject to Business Taxes, including income tax, sales and use tax, gross receipts tax, property tax, and other excise taxes. In the article we try to review all type of taxes in Nebraska.

The Nebraska sales tax rate is 5.5%. This applies to the purchase of all taxable items and services in the state. There are some exceptions to this rate, including certain food items, prescription drugs, and medical supplies.

If you are a business owner in Nebraska, you are responsible for collecting and remitting sales tax to the state. Failure to do so can result in penalties and interest.

As a consumer, you may also be responsible for paying use tax on purchases made from out-of-state retailers that do not collect Nebraska sales tax. Use tax is due on the purchase price of taxable items when sales tax has not been paid at the time of purchase. More information on use tax can be found on the Nebraska Department of Revenue website.

Nebraska Sales Tax Rates Calculator Online

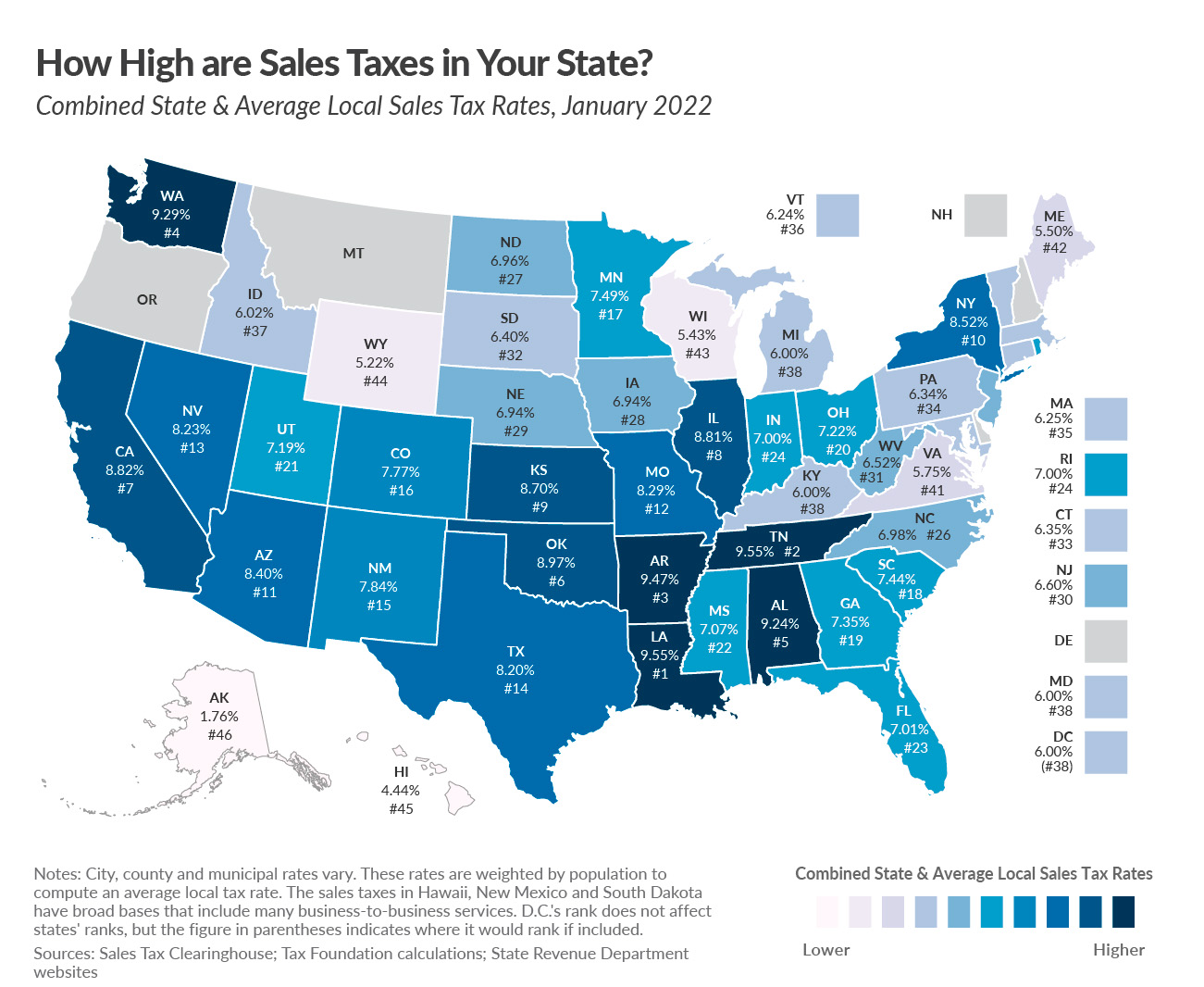

Sales tax rates in Nebraska are determined at the city and county level. There are no state sales taxes in Nebraska. Some cities and counties have multiple rates, which can include a base rate, additional local rates, tourism rates, utility rates, and more. The Nebraska Sales Tax Rates Calculator can help identify the applicable sales tax rate for any location in Nebraska.

The Nebraska Sales Tax Rates Calculator will help you identify the correct sales tax rate to charge for any location in Nebraska. Simply enter the 5-digit zip code of the location where the sale took place, and we’ll calculate the applicable sales tax rate.

Keep in mind that some cities and counties in Nebraska charge additional local sales taxes on top of the state sales tax. The total sales tax rate in a particular city or county can be as high as 7%.The Nebraska Sales Tax Rates Calculator is provided as a free service to our users. We make every effort to ensure that the calculator is accurate, but we cannot guarantee that it will always be up to date. If you find an error, please let us know and we will do our best to correct it. The highest sales tax rate in the state is 7% in Hastings. Other cities with high sales tax rates include Omaha (6.5%), Lincoln (6%), Grand Island (6%), and Kearney (6%).

Nebraska sales tax resources include:

- The Nebraska Department of Revenue Sales and Use Tax Rate Tables

- Nebraska Sales Tax Holidays

- File a Nebraska Sales Tax Return

- Nebraska Sales Tax Exemptions

- Nebraska Sales Tax Rates by County and City

Collect sales tax in Nebraska

If you are an out-of-state seller with sales tax nexus in Nebraska and you have not registered with the state, you should do so as soon as possible. You can register for a sales tax permit on the Nebraska Department of Revenue website. Once you have obtained your permit, you will be responsible for collecting and remitting Nebraska sales tax on all taxable sales made to customers in the state.

When it comes time to file your Nebraska sales tax return, you will report all of the taxable sales you made during the reporting period. Be sure to include any exempt sales in your total so that they can be subtracted from the amount owed. If you collected too much sales tax from your customers, you will be issued a refund.

What you’re selling taxable?

Most items and services in Nebraska are taxable. This includes, but is not limited to:

- Food and beverages sold for consumption on or off the premises

- Lodging-Retail sales of clothing and footwear

- Admissions to movies, concerts, amusement parks, and other entertainment venues

- Sales of motor fuel

- Tangible personal property (e.g., furniture, electronics)

- Intangible personal property (e.g., digital products, downloadable software).

Some items may be exempt from Nebraska sales tax, including but not limited to:

- Groceries

- Prescription drugs

- Certain medical devicesTo learn more about exemptions.

Individual Taxes

Nebraska residents are subject to a state income tax of 5.01%, as well as federal income tax. The state’s income tax brackets range from 2.46% to 6.84%, depending on an individual’s taxable income.

Business Taxes in Nebraska

Businesses in Nebraska are subject to a number of taxes, including corporate income tax, sales and use tax, property tax, and payroll tax.

The Nebraska corporate income tax rate is 6.84%, which is imposed on C-Corporations doing business in the state. Businesses that are organized as S-Corporations or LLCs are not subject to the corporate income tax, but may be subject to the state’s franchise tax.

All businesses in Nebraska that sell taxable goods or services must collect and remit sales tax to the state. The current sales tax rate in Nebraska is 5.5%. Businesses that make taxable purchases for resale, manufacture, or processing must pay a use tax instead of sales tax. The use tax rate is the same as the sales tax rate: 5.5%.

Nebraska levies a property tax on all real and personal property within the state. Businesses are responsible for paying property taxes on any business-owned property, including buildings, machinery, equipment, inventory, and land. The average effective property tax rate in Nebraska is 1.29%.

All businesses with employees in Nebraska are required to withhold and remit payroll taxes to the state. Businesses must withhold income tax from their employees’ paychecks, as well as pay unemployment insurance taxes and workers’ compensation insurance premiums. The current unemployment insurance tax rate in Nebraska is 0.6% - 6.0%, depending on the amount of wages paid by the employer during the calendar year.

Property Taxes

All businesses in Nebraska are responsible for paying property taxes on any business-owned property, including buildings, machinery, equipment, inventory, and land. The average effective property tax rate in Nebraska is 1.29%.

Payroll Taxes

All businesses with employees in Nebraska are required to withhold and remit payroll taxes to the state. The current payroll tax withholding rates in Nebraska are 4.63% for state income taxes and 6.84% for federal income taxes. Businesses are also responsible for paying the employee’s share of payroll taxes, which includes Social Security (6.2%) and Medicare (1.45%).

Income Taxes

All businesses operating in Nebraska are required to pay corporate income taxes to the state. The current corporate income tax rate in Nebraska is 7.81%. Businesses may also be responsible for paying other types of business taxes, depending on the type of business they operate and the products or services they provide. For example, businesses that sell alcohol or tobacco products may be responsible for paying excise taxes on those products. Businesses that sell tangible personal property may be responsible for collecting and remitting sales taxes to the state.

Conclusion

The state of Nebraska imposes a variety of taxes on businesses operating within its borders. Businesses are responsible for paying corporate income taxes, as well as other taxes depending on the type of business, products or services provided. Businesses should consult with an accountant or tax attorney to ensure they are in compliance with all applicable tax laws.

They may also be responsible for other business taxes, depending on the type of business, products or services provided. Businesses should consult with an accountant or tax attorney to ensure they are in compliance with all applicable tax laws. You can find more information on the Nebraska Department of Revenue website.

For over 20 years, numismatics has been an integral part of my life. I’m an expert in the field, including research, grading, and analysis of data. I have written thousands upon articles about this subject. I continue to author reports and update price guides. I enjoy writing and sharing the passion and excitement of the hobby with veterans and new generations. I am analytical, precise, and highly disciplined. These traits have always helped me achieve outstanding results in my career.