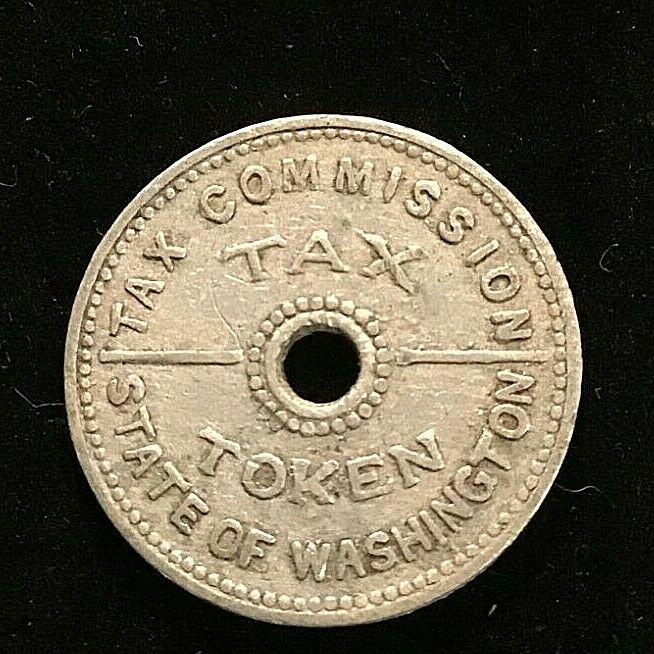

The idea of Washington tax tokens dates back to the 1930s, when only a few states adopted this method of collecting taxes. Unlike currency, however, tax tokens are not considered a form of currency. They are considered fractional coins. Because they are not a legal tender, Washington has a very unique legal system. In the 1930s, the state passed a law allowing sales tax tokens. It was the first state to use this method.

Washington tax tokens were originally issued by state governments to collect sales tax. They were commonly used by merchants to account for small purchases. But with the advent of the modern bracket system, they have become less of an issue. Today, most Washington tax tokens sell for $1 to $5 US dollars, although some are worth more than this. The best source for detailed information on tax tokens is the American Token Society. If you want to learn more about Washington tax tokens, there are many resources available.

The Federal Government Takes Notice of Washington State Tax Tokens

In 1921, the Washington State government passed legislation allowing tax tokens. Tokens were used by consumers to pay a fraction of sales tax. This practice was quickly abandoned, but as the tokens were widely used in commerce, the federal government started taking notice. Since these tokens were not considered money, the government began to consider them a violation of its money mandate. In 1935, Washington state was only one of eight states actively issuing these tax tokens. At that time, Illinois, Ohio, Missouri, and New Mexico were also actively pursuing this issue. These states continued to use the tokens until the early 1960s.

Eventually, the federal government began to take notice of the practice and banned tax tokens. These tokens were used widely in everyday commerce, but the federal government viewed them as conflicting with their money mandate. By the end of the decade, Washington was the only state actively issuing these tax tokens. In fact, seven other states were actively issuing them. By the late 1940s, some states continued to use them until the 1970s.

The Washington State sales tax token was widely used until the late 1930s.

- - At that time, sales tax tokens were only used for small purchases and were rarely used in large stores.

- - In 1935, however, many states had already adopted this system.

- - By the late 1940s, the state of Washington was the only US state to use tax tokens. In contrast, today, sales tax tolls are collected in the same way. A single token in the same state is considered a tax.

Washington Tax Tokens: Rare, Useful and Interesting

When Washington tax tokens were first introduced, they were controversial. Originally issued as fractional-cent devices, Washington tax tokens are now widely accepted in the United States and can be found at many places. Washington Tax Tokens come in multiples of 1 mill or one tenth of a cent and are used by local governments and private firms to collect sales tax. Washington Tax Tokens can also be divided into smaller parts called fractions (1/1000), which makes them easier to count!

The original plan to collect sales tax was a controversial idea. While Washington tax tokens are not legally accepted in the United States, they do have a unique history. Originally issued as fractional-cent devices, they were used by local governments and private firms. They were generally issued in multiples of 1 mill or one tenth of a cent. Fortunately, they are still in use today. There are also a few other reasons why people use Washington tax tokens.

In 1935, Washington State passed legislation to allow the use of tax tokens in its sales tax collection system. At the time, it was primarily a local issue, but by the early 1940s, they were widely used in Washington State. They were not always effective, and the federal government regarded them as an “inconvenient” practice. Nevertheless, the use of tax tokens in these states was controversial, and the use of these small, colorful, and convenient pieces of paper is not widespread.

In the late 1950s, Washington State introduced legislation allowing the use of tax tokens. The use of these tokens was popular, as they allowed citizens to pay sales tax fractionally without incurring much hassle. The federal government took notice of the use of the payment method in 1935, but the federal government still regarded it as a violation of its money mandate. In the same year, the issue of the tax tokens was a popular alternative to cash.

Despite their widespread use, Washington State has resisted the federal government’s efforts to make them legal tender. The government has always viewed them as an unholy innovation, which contradicts its money-based mandate. The tax tokens, however, were legal in the state of Washington and have remained so ever since. If you are interested in collecting these tax tokens, you can read more about their history in our articles.

For over 20 years, numismatics has been an integral part of my life. I’m an expert in the field, including research, grading, and analysis of data. I have written thousands upon articles about this subject. I continue to author reports and update price guides. I enjoy writing and sharing the passion and excitement of the hobby with veterans and new generations. I am analytical, precise, and highly disciplined. These traits have always helped me achieve outstanding results in my career.